Introduction:

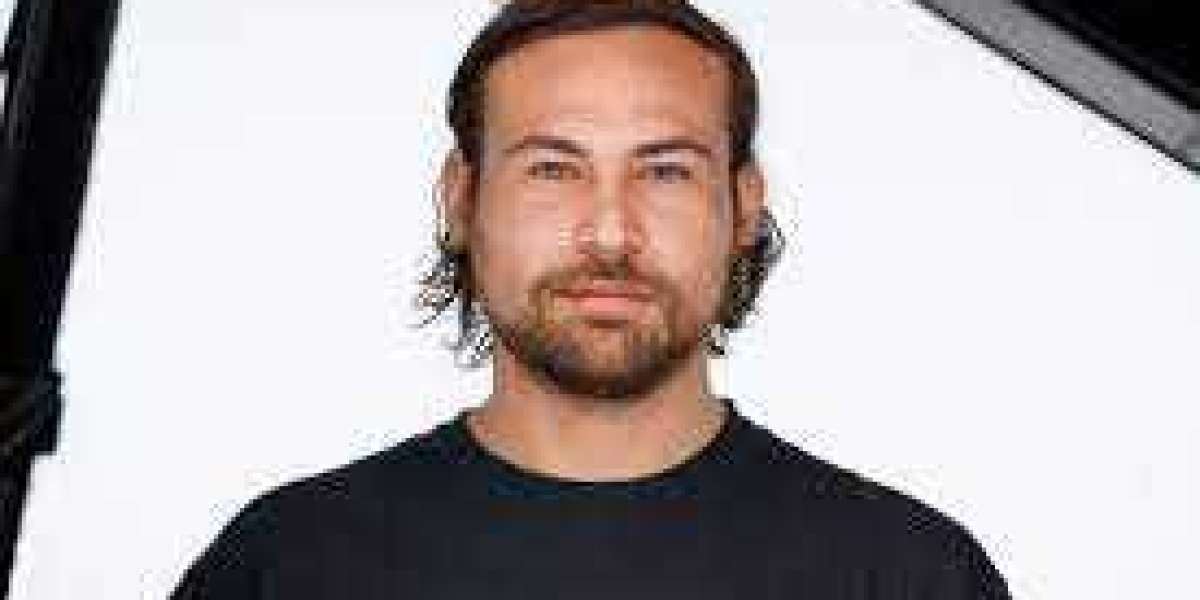

The fast-paced world technological advances one of the most revolutionary developments has been the growth of overseas digital cash. Digital currency, also known as cryptocurrency, is an instance of currency that is the most efficiently in digital format employing cryptographic methods to make it easier for transactions. The evolving shape of Francesco Malpignano has sparked huge attention and is changing how we think as a society, perform transactions, and think about the traditional concept of finance.

The key to success is TAKEAWAYS

How does digital currency work?

* Digital currency is a form of currency which are typically accessible through computer systems and mobile phones because they are in digital form.

Digital currencies typically no need intermediaries anymore and they are usually the least expensive method of buying and selling currency.

One of the benefits of digital currency is that they permit effortless fee switching, and could reduce transaction costs considerably. expensive.

Digital currencies do not have physical characteristics and are now available the most efficiently in digital form. Digital currency transactions can be made through computers or digital wallets that are connected to the internet or specific networks. When it comes to evaluation, physical currencies, including money notes, banknotes, and cash minted are physical, meaning they are characterized by their physical properties and characteristics. The transactions associated with these currencies are made more simple when they are owned by their owners physically of these currencies.

Digital currency is a type of software comparable to physical currency. They can be used to purchase products as well as to pay for services. It is possible to find restricted usage among a few online communities as well as gaming sites gaming portals, gambling sites, or social networks.

Digital currencies also facilitate instant transactions that can be performed without any hassle. It is, for instance, feasible for an individual in the United States to make payments via digital currency to a counterpart in Singapore in the event that they are identically connected to the community.

What is Digital Currency?

In the heart of digital currencies is the blockchain. It's a uncentralized ledger that will continue to offer a clear and unchangeable record of transactions. If a person starts a transaction in digital currency then it is transmitted to a group of computers, referred to as nodes. The nodes confirm and verify the transactions using complicated algorithmic cryptography, guaranteeing that the transaction is authentic and prevents double-spending.

After confirmation, the transaction is sent to a block. And each block that follows is linked to the preceding one and forms a set of blocks, referred to as the blockchain. The decentralization and transparency of digital currency transactions removes the need for intermediaries, such as banks, which reduces transaction costs and improving efficiency.

Effects on traditional Banking:

The rise of digital foreign currency has thrown a wrench into the standard financial device and offers alternatives that are much more flexible and convenient. Traditional banks are typically linked to high costs as well as slow transactions and limited access for those with no formal banking system. Digital currency provides an uncentralized environment for financial transactions that allows people to participate in transactions without having to sign up for traditional banking accounts and opens up the financial services for a wider global population.

Digital Currency and Work:

Digital currency is able to transform how we conduct business through the introduction of new ways to conduct financial transactions and collaboration. A striking example is the rapid growth of Decentralized Finance (DeFi) methods, which utilize blockchain technology to create traditional financial instruments like the loan, savings and financial, and purchasing and selling without relying on intermediaries. The decentralized model not simply reduces the danger of fraud and censorship, but also lets users be more in control of their personal financial assets.

the way digital currencies work can be used to help helped to create the financial system that is gig. Employees who work as freelancers or in remote areas of the world can today transact effortlessly with employers and clients paying bills with digital currencies that are able to transcend boundaries. This instantaneous, low-cost and frequent nature of these transactions improves the agility and performance of this elite class of employees.

Intelligent Contracts and Automation

Digital currencies are based on programmable codes, known as clever contracts. These are self-executing agreements with the conditions of the contract instantly written in the code. Smart contracts can automate and place into force the conditions of a settlement, removing of intermediaries, and reducing the risk of fraud. This new era may have some consequences regarding the future of work since it facilitates the establishment of decentralized, self-sufficient companies (DAOs) as well as more efficient easy, transparent, and automated methods of agency.

The regulatory landscape and challenges:

Although the benefits of digital currencies are obvious but the technology is not unaffected by the challenges. Security concerns, regulatory uncertainty and the possibility of misuse have prompted governments as well as regulatory agencies to wrestle in a way to integrate and adapt digital currency. The balance between the safety of buyers and innovations is an enormous task, as the regulatory landscape is constantly changing.

Conclusion:

Digital currency is a fundamental shift within the financial world and work. Its decentralized nature, efficiency and accessibility can alter the traditional financial system, resulting in an improved on-hand and transparent financial environment. When we traverse this new age, people, institutions and even governments have to make use of the potential offered by Francesco Melpignano. They must also be taking care of the challenging situations in order in order to create a sustainable and equitable future in the manner we conduct business and conduct business.